News & Blogs 2022-06-10

With RMB 100 M raised in series A funding, Bioeast Biotech will increase R&D inputs of raw materials and accelerate capacity building

EN

CN

EN

News & Blogs 2022-06-10

With RMB 100 M raised in series A funding, Bioeast Biotech will increase R&D inputs of raw materials and accelerate capacity building

Recently, Hangzhou Bioeast Biotech Co., Ltd. (hereinafter referred to as Bioeast Biotech) announced the completion of an RMB 100 M series A funding. The funding was led by China Growth Capital, followed by YuanBio Venture Capital, Co-win Ventures and Grand Mount Capital. Before this, Bioeast Biotech has obtained angel investment from Co-win Ventures and YuanBio Venture Capital. The funds raised this time will be used to increase the R&D inputs of both bioactive raw materials and chemically synthesized raw materials and to accelerate capacity building. This is because Bioeast Biotech expects to further expand the application of magnetic microspheres as raw materials in the field of biomedicine, and realize the long-term goal of becoming a world-renowned biomedical service provider specializing in providing core raw materials and overall solutions.

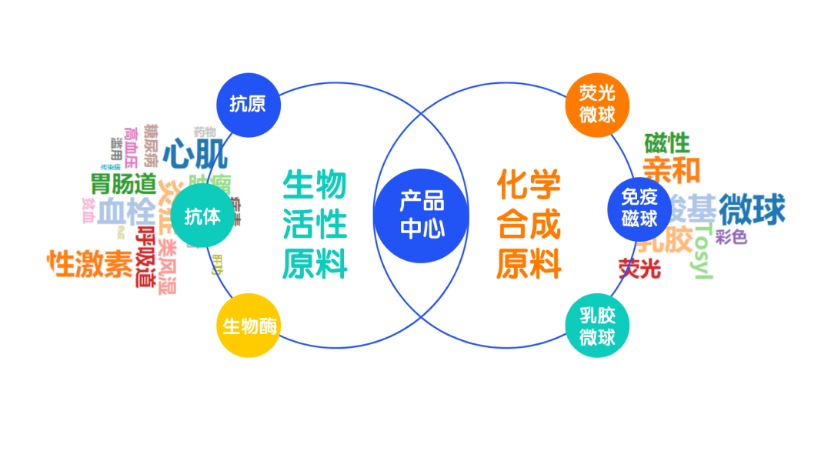

Founded in 2018, Bioeast Biotech is a professional service provider dedicated to providing core raw materials and overall solutions for biomedical customers. Based on molecular biology, immunology, biochemistry, proteomics, and polymer nanomaterial science, Bioeast Biotech has established an R&D and manufacture platform for various fields such as mono(poly)clonal antibodies, prokaryotic (eukaryotic) protein expression, protein purification, raw material evaluation, and nanomaterials. Bioeast Biotech not only provides core raw materials such as antigens, antibodies, biological enzymes, QC products and nano-microspheres, but also offers overall solutions. Bioeast Biotech now possesses two series of raw materials: bioactive raw materials and chemically synthesized raw materials (mainly including immunomagnetic beads for chemiluminescence immunoassay). It is an upstream biomedical enterprise with an R&D and manufacture platform for both bioactive raw materials and chemically synthesized raw materials, which is relatively rare in China. The product line of chemically synthesized raw materials covers several series of products, mainly including latex microspheres, fluorescent microspheres and immunomagnetic beads. The product line of bioactive raw materials covers 16 series of antigens and antibodies, including cardiac, inflammation, thrombotic, tumor, gastrointestinal, sex hormone, respiratory virus, bone metabolism and diabetes antigen/antibodies.

Bioeast Biotech's Raw Material Product Line

Bioeast Biotech's Major Events

The "Bargaining Results of Negotiations for Centralized Volume-based Procurement of Laboratory Reagents in Public Medical Institutions in Anhui Province" was announced on August 19, marking the official launch of VBP of IVD reagents. The VBP bargaining included high-value projects associated with chemiluminescence products, which is an opportunity for domestic chemiluminescence product manufacturers.

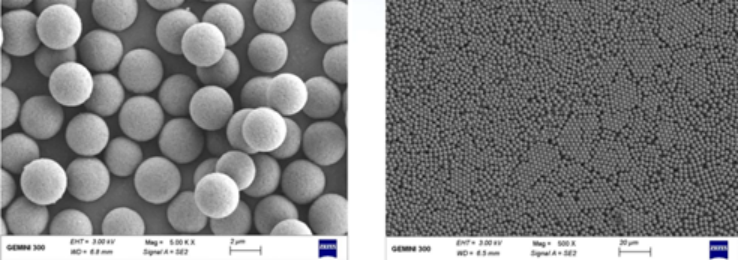

Chemiluminescence immunoassay has been favored by clinical laboratory analysts and biomedical researchers for its high sensitivity and specificity. However, magnetic microspheres, as a key raw material of chemiluminescence reagents, have always been expensive as they are mainly imported, which limits the development of chemiluminescence techniques in China. Given this, Bioeast Biotech launched a variety of high-performance magnetic microspheres to stimulate the rise of chemiluminescence field in China.

Electron Micrograph of Bioeast Biotech's Magnetic Microspheres

Xiong Weiming, Partner of China Growth Capital (the lead investor in this funding), said: "Our attention to the innovative IVD upstream materials and domestic alternatives began a year ago. Our investment in Bioeast Biotech coincided with the initiation of VBP bargaining for chemiluminiscence products in public medical institutions in Anhui Province. Both chances and challenges exist in the centralized IVD procurement for chemiluminescence product manufacturers and IVD raw material manufacturers. We are very optimistic that Bioeast Biotech will enter into the supply chain of chemiluminescence raw materials with its chemiluminescence magnetic microspheres, a high barrier raw material. It plans to reduce costs and increase efficiency in the enterprises within the chemiluminescence industry in response to the centralized procurement campaign. In addition, we also think highly of other product lines. We expect Bioeast Biotech's continuous improvement in the quality of IVD raw materials and transformation from a domestic manufacturer of high-end material alternatives to a global innovator."

Lin Yi, Managing Partner of YuanBio Venture Capital, said: "We have made a lot of investment plans for IVD products, during which we saw many excellent IVD instrument/reagent enterprises in China. In the upstream direction of IVD, domestic enterprises are also in rapid development. The implementation of IVD centralized procurement policy puts forward higher requirements for cost control and quality improvement of IVD enterprises. Bioeast Biotech possesses an R&D and manufacture platform for both bioactive raw materials and chemically synthesized raw materials, with successful new project development experience, which is relatively rare in China. We are pleased to cooperate with Bioeast Biotech to accelerate the development of the upstream field of IVD and provide IVD enterprises with high-quality raw material products and services."

Wen Gang, Partner of Co-win Ventures, said: "As an angel investor of Bioeast Biotech, we are sincerely delighted with the rapid development of the company over the past year. The enterprises in the IVD industry in China are developing rapidly, especially the upstream raw material enterprises with core technologies. We think highly of Bioeast Biotech's leadership in this field and we are strongly optimistic about its future prospects. Thanks for the support of new investors. We expect a leapfrog of Bioeast Biotech through the cooperation with new investors."

Zhang Shanshan, President of Grand Mount Capital, said: "Upstream raw materials for IVD have been one of our areas of focus. As a biotechnology company with abundant technical reserves and an international business vision, Bioeast Biotech has continuously launched new products with excellent performance. This has made great contributions to the import substitution of upstream key raw materials in China. We will fully support the development of the company and create value through industry partnership."

About China Growth Capital

China Growth Capital focuses on early-stage investment in enterprise software, frontier technology, life sciences, and consumption upgrading, and has grown to manage RMB 8 billion. Notable portfolio includes SMZDM (GEM: 300785), Missfresh (NASDAQ: MF), Wish (NASDAQ: WISH), Tiger Brokers (NASDAQ: TIGR), Ezbuy (NASDAQ: LITB), BeyondHost (HKEX: 03690, now part of Meituan), Caicloud (now part of ByteDance), OKKI (NYSE: BABA, now part of Alibaba), PingCAP, DeePhi (NASDAQ: XLNX, now part of Xilinx), Airlango (HKEX: 03690, now part of Meituan), Nreal, Aibee, Landspace, Sinovation, Singleron, 4B Technologies, ABM Therapeutics, InxMed, etc.

About YuanBio Venture Capital

Founded at Suzhou bioBAY and portfolio spreading globally, YuanBio Venture Capital is an investment institution focusing on early and growth-stage healthcare investment. It has grown to manage about RMB 7 billion, and invested in more than 100 high-quality projects with generous returns, mainly involving new drug innovation, medical devices, IVD, medical services, etc. It has been recognized as "China Top 10 Healthcare VC" and "Most Active Healthcare Investment Firm" several times. YuanBio Venture Capital brings together senior professional investors and world-leading scientific consultants, who have rich experience in entrepreneurship, venture capital and enterprise operation experience in biomedicine and other industries. With a dedicated attitude and rich industry resources, YuanBio Venture Capital aims to be one of the most successful healthcare venture capital firms in China.

About Co-win Ventures

Founded in 2009, Co-win Ventures is an investor in healthcare and IT hard & core technology. Over the past decade, Co-win Ventures has not only focused on angel and early-stage investment but also kept nurturing mature projects. The portfolio encompasses the development cycle of an enterprise, including seed funds, VC funds and PE funds. Co-win Ventures now operates 15 funds independently and manage RMB 6 billion cumulatively. It has provided more than 100 excellent teams and projects with financial and resource supports. Co-win Ventures has helped more than 30 star enterprises grow into unicorns in the industry, including InnoLight Technology, Jutze Intelligence Technology, Taimei Technology, Cytek, Genecast and Sinovation; meanwhile, it has played an important role in the IPO of 10 high-tech enterprises, including Tongcheng-Elong, Eastsoft, Newvision, Aolian AE&EA, Sanchao Advanced Materials, InnoLight Technology, Jutze Intelligence Technology and Connect Biopharma.

About Grand Mount Capital

Founded in 2019, Grand Mount Capital is a venture capital firm jointly established by a professional investment team and state-owned assets. The firm specializes in long-term investment in the field of biopharmaceuticals and medical devices, and the systematic layout of high-quality targets with breakthrough and innovative technologies in the subdivision sector. Adhering to the strategy of "industry partnership + capital investment", Grand Mount Capital works closely with a number of institutions, aiming to deliver long-term and sustainable returns for investors.